In 2023, several events reinforced the present global uncertainty, with the persistence and worsening of the Ukraine/Russia war, the rebirth of the Middle East conflict, and the celebrations and fears around the rise of artificial intelligence. Concerns about inflation continued to increasingly affect the financial markets globally with interest rates reaching their highest levels of the last 15 years. After a good performance in 2022, despite the great challenges generated by the continuous escalation of production costs, BA Glass and Cerealis managed to fully re-establish their business balance and achieved strong results in 2023. BA Glass took important steps in its inorganic growth trajectory, completing the acquisition of a glass packaging company in Mexico and a recycled glass treatment company in the United Kingdom. Cerealis successfully completed the increase of its stake in Europasta (Czech Republic) to a majority controlling participation. Investments in private equity, venture capital and infrastructure funds were reinforced with an increasing focus on geographical and sector diversification. Teak Capital continued to promote its forestry and agroforestry project, having significantly augmented the set of assets under management in different regions of Portugal and, in December 2023, acquired 50% of Quinta do Vallado from the Ferreira Family, aiming to contribute to the growth of the business grounded on its bases of value and differentiation, which are related to the tradition and the quality of its products, land and touristic assets.

Edifício Oceanus, Avenida da Boavista, 3265 - 3.3

4100-137 Porto

info@teakcapital.pt

+351 22 245 0710

close

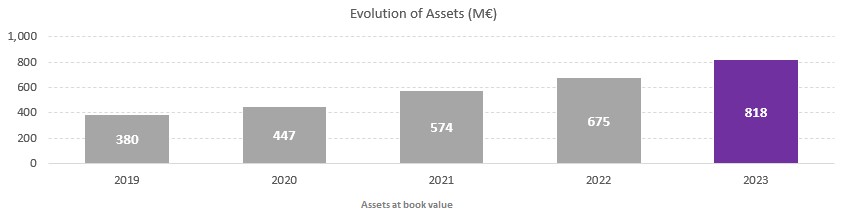

Assets at book value

close

close